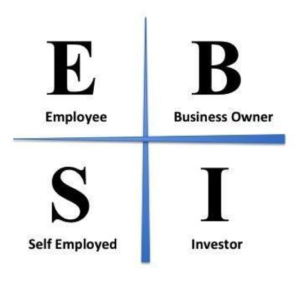

Cashflow Quadrant

People who are on the left side of the quadrant they are the Employees and Small Business Owners or Self Employed who are paying the highest taxes and they are spending their time for money.

On the right side of the quadrant we have the Big Businesses (300 employees or more) and Investors. They are paying the least taxes and they are also investing in assets that are generating money for them while they are sleeping.

Employees – The most important thing for the Employees is the security. They want steady paycheck and steady salary. They are not risk takers. When they need more money they are searching for a job with bigger salary. Employees are paying high taxes.

Self Employed or Small Business Owners (doctors, lawyers, accountants etc) – they are paying the highest taxes. It’s interesting that most of them are having ego problems and they have the attitude that everyone is doing worse than them. They don’t want to hire employees because they think no one can do better than them and because of that they only make money when they are working. They are spending most of the time working for money.

Investors – they are the most financially educated people in this quadrant. They acquire assets that are generating income in form of cash flow. They also know how to use dept in order to acquire assets instead of liability. Investors are using the income from those assets to acquire more of them so they keep building their wealth. Investors are enjoying the tax breaks. The richest people in the world are investors.

Big Business Owners have system or product that makes money for them even when they are not working. Business Owner are looking for people to work for them who are highly specialized in skills that are needed for the business. It’s interesting that they can leave the company for year or more and find it still profitable when they come back. They are big risk takers but according to them there is nothing riskier than being an employee. When they are in crisis they are creating a new product or system that will generate money.

The Cashflow Quadrant

Asset vs Liability and how to turn Liability into Asset?

Before we talk about this we have to discuss what is asset and what liability is.

Asset is something that you own and puts money in your pocket. The assets are providing future economic benefits. Assets can be patents, stocks, real estate, individual property, gold etc. Robert Kiyosaki said that the single most powerful asset we have is our mind. If trained well it can create enormous wealth.

Liability is something that takes money of your pocket. Examples for liability are credit cards, vacation, houses, cars etc. The poor people are full of liabilities. It’s interesting that there are things that people think that they are assets but they turn out to be liability.

How to turn the liability into an asset – Our houses and cars are liability because they are taking money out of our pockets for maintaining, fuel etc. But if we turn the house into rental property it will put money in our pockets, if we rent our car to someone to drive taxi it will put money in our pockets.

How poor people, middle class and rich people are investing their money.

Poor people – They don’t. Poor people, if they have a job they go to work and they are spending their salary on expenses and they run out of money quickly.

Middle class people – They go to work, they get salary that gives income and they are investing their income in liability like houses, cars, vacations that are generating expenses.

Rich people are investing in assets like real estate, stocks, patents etc. The assets are generating income. They are using the income to invest more in assets. More assets more income they have.

Conclusion

It’s very important to understand the difference between asset and liability, how to distinguish asset from liability. We need to know how to spot our liability and learn how to turn them into assets that will generate income and use that income to acquire more assets.